Family of Woman Killed at Atlanta Apartment Complex Wins $3.8M Verdict, Another Suit Threatens Recovery

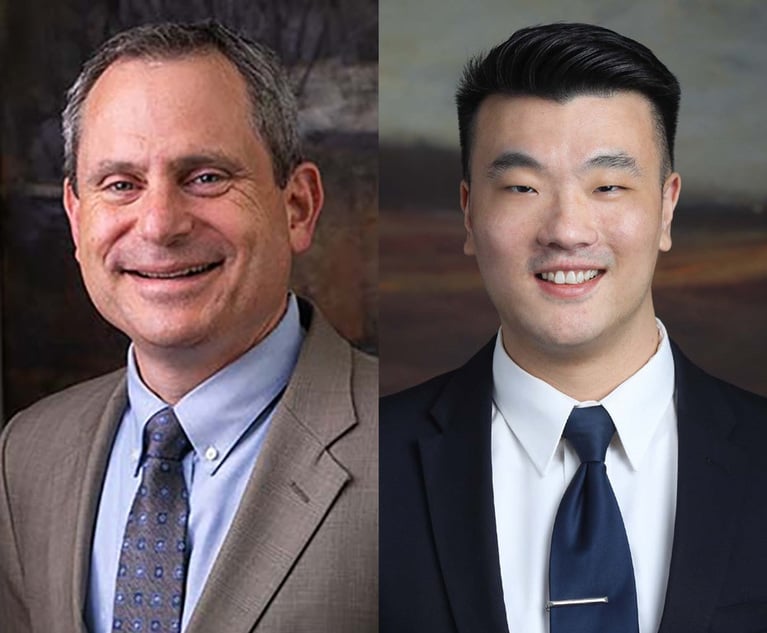

"I think the jury concluded that companies shouldn't make profit when they result in people being killed or severely injured, and that makes a lot of sense," plaintiffs' counsel, Mike Rafi of the Rafi Law Firm in Atlanta, told the Daily Report. "They didn't want a company making money when their behavior disregarded such obvious problems."

By Mason Lawlor

4 minute read